It’s that time of the year again: the big thaw has concluded, the warmer temperatures have arrived, and a fresh Spring breeze is in the air. Ahh yes, Spring has sprung, and Summer months are on the horizon. It’s time to get ready for those backyard barbeques, days by the pool, and extreme weather systems. Hey, it can’t always be fun in the sun, right?!

Last week, we kicked off a new blog series called Protect Your Throne. Each week, we’ll discuss those unfortunate exposures that put your modern-day castle in peril. Our first installment in the series focused on preventing an avoidable loss while having fun in the sun, the things that we tend to have some control over, like preventing injury around pools and trampolines. This week, we’ll focus on some of the things you can’t control; extreme weather.

Whether it’s a tornado, severe storms, hurricanes, or wildfire, or flood, we’ve all likely experienced an extreme weather system at one point in time. Annual extreme weather events are so common that the insurance industry has developed an entire designation and claims process specifically for them, called catastrophic claims.

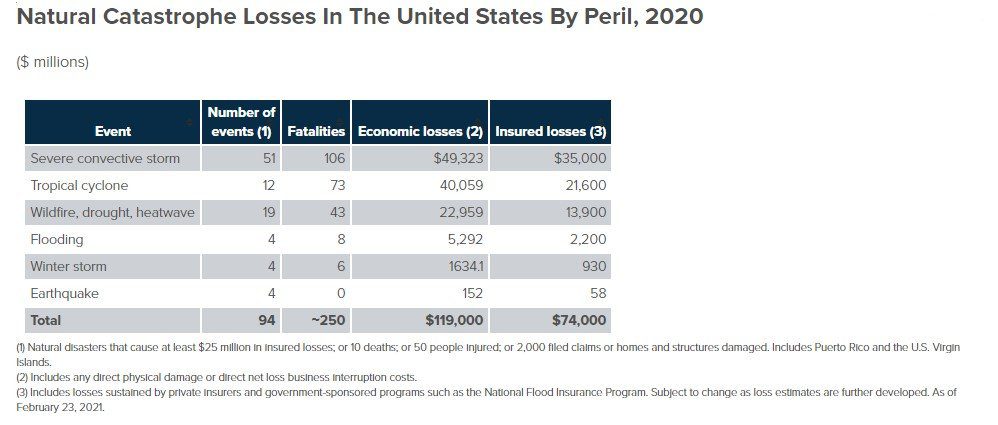

A catastrophic weather event is described as, “a natural event that causes $25 million or more in insured property losses, or 10 deaths; or 50 people injured; or 2,000 filed claims or homes and structures damaged.” According to the Insurance Information Institute, in 2020 alone there were $74.4 billion in property damage claims from catastrophic weather events, with a majority of those events occurring during warmer seasons. With that being said, it’s time to get prepared for another season of catastrophic weather so that you don’t become a part of the 2021 statistics!

So, what steps should you take to protect your throne from unavoidable weather events, no matter how minor or catastrophic? It all starts before the storm rolls in with preventative maintenance.

- Inspect the exterior of your home and look for any vulnerabilities that could cause water to breach the exterior of your home. This includes checking for damaged or missing shingles, siding, fascia, and windows. Be timely in repairing any damaged and vulnerable areas caused by wear and tear, like curling, peeling, or mossy roof shingles.

- Ensure your gutters are securely attached to your home and clean them to prevent downspouts from clogging, ensuring water is being carried away from the foundation of the home. This will help prevent hydrostatic pressure from causing damage to and breaching your home’s foundation.

- If you have a sump pump, make sure it’s in good repair and consider replacing it if it’s toward the end of its life cycle. Sump pump failures due to age and power outages are common and often require additional coverage. Talk to your agent to ensure that you are properly covered against water backup losses!

- Trim your trees of loose and overgrown branches! Also, make sure that no tree branches are brushing against the exterior of the home. Downed trees & tree debris are a common cause of loss to roofs, sidings, and windows. They are also a trip and fall hazard, so be sure to clear any down tree branches and debris from your yard to prevent a liability claim.

- Clean and secure outdoor living spaces to prevent loss of personal property. Unsecured personal property, like outdoor furniture and decor, can be blown away or thrown at a structure during storms, causing property damage and personal property loss. That’s what we call a double whammy!

- Lastly, one of the most important steps you can take to protect your throne from an unavoidable weather loss is to know what to do when a loss does occur. As a policyholder, you certain duties when a loss does occur so it’s important to be aware of those duties:

- Prevent further loss to the property. Contact a restoration or remediation service, if necessary. For example, if there’s a water backup, the water needs to be extracted and the affected area dried to prevent mold and health hazards.

- Promptly notify your insurance agent and company of the loss. Have a copy of your policy and emergency claims phone number handy.

- Document the loss with pictures and do not throw away any damaged property prior to working with your adjuster. We also recommend that you keep a good inventory of personal property and a record of significant purchases (like electronics, furniture, etc). This will help expedite any claim that involves a personal property loss.

- Talk to your agent about your coverage before a loss occurs. Express any concerns or unique features of your home that require additional coverage, like additional structures, such as a barn or guest house, on your property that likely exceed the included policy level coverage. We also encourage jewelry, firearms, silverware, and collectibles to be specially named on the policy to prevent being subject to policy provisions and sub-limits on such items.

By taking these steps annually and being mindful of the losses that can occur around your property, you can help protect your modern-day castle and continue to sit confidently on your throne.

Interested in learning more? Please email us at hello@veroinsure.com or call 773-945-9000.

Vero Insurance is a niche broker with a focus on providing insurance placement and risk management services to high-income families. Here at Vero, we love to provide you with exciting and fun articles to learn more about insurance and how it impacts your life. Visit our other blogs to find more information.

While Vero does offer a wide variety of personal insurance coverages, our main coverages include personal umbrella insurance, auto insurance, and homeowner’s insurance.